- Bonzo Bytes

- Posts

- Bonzo Bytes Newsletter - #47 🐵🗞️

Bonzo Bytes Newsletter - #47 🐵🗞️

🪙 $wETH now live on Bonzo Finance for lending and borrowing

Hello, Bonzo Community!

Welcome to another edition of the Bonzo Bytes Weekly Newsletter.

$wETH Goes Live on Bonzo Finance

The $wETH asset is officially live on @bonzo_finance and available for lending & borrowing 🫡

🌉 $wETH is an ERC-20 asset (vs HTS) issued by @LayerZero_Core — it can be bridged to @hedera via @StargateFinance: stargate.finance/bridge?dstChai…

$wETH Address: hashscan.io/mainnet/contra…

📊

— Bonzo Finance Labs (@bonzo_finance)

3:42 PM • Oct 31, 2025

Bonzo Finance has officially onboarded $wETH, expanding support beyond HTS assets. The ERC-20 asset, issued by LayerZero, can be bridged to Hedera via Stargate and is now available for both lending and borrowing on app.bonzo.finance.

Brady Gentile, Bonzo Finance Labs Co-Founder & CEO, shared that this upgrade required a major protocol rework:

“The team upgraded the entire code base to support ERC-20 assets alongside HTS assets, and Halborn audited the changes before launch.”

Bonzo Finance Merch Store Is Live

merch acquired 🍌🌙

— NoMansInternet.ℏbar (@nomansinternet)

3:53 PM • Nov 3, 2025

The first orders from the Bonzo Merch Store are out for delivery, and community response has been overwhelmingly positive.

Three collections are now available: Founders, NFT, and Vaults, featuring designs inspired by Bonzo’s ecosystem and artwork. Some items also include a hidden Easter egg. Call 1-866-BONZO-FI to find out more…

Bonzo Vaults Update

Bonzo Vaults are set to go live during the week of Sunday, November 9.

During final testing, the Bonzo Finance Labs team identified a bug within the Bonzo Vaults CLM strategy. The issue has been shared with our auditing partner, @HalbornSecurity, who is supporting remediation

— Bonzo Finance Labs (@bonzo_finance)

8:26 PM • Oct 28, 2025

Brady confirmed that the Bonzo Vaults launch is targeted for the week of November 9th, with final testing and auditing underway.

“One of the things discovered in testing was a bug in the CLM strategy,” he explained. “We’re working with Halborn to remediate before launch. Security always comes first.”

Vaults are expected to launch with three strategies: CLM (Concentrated Liquidity Management), Single-Sided CLM, and 2x Leveraged Liquid Staking Yield. Each is designed to stay native to Hedera while offering automated yield opportunities.

“We want to put out a product that’s secure and usable”, Brady said. “There are always risks in DeFi, but we go through a lot of steps… audits and extensive testing to make it as safe as possible.”

🔗 Read more in the Bonzo Finance Blog post: Bonzo Vaults: Automated Yield Strategies for Hedera DeFi

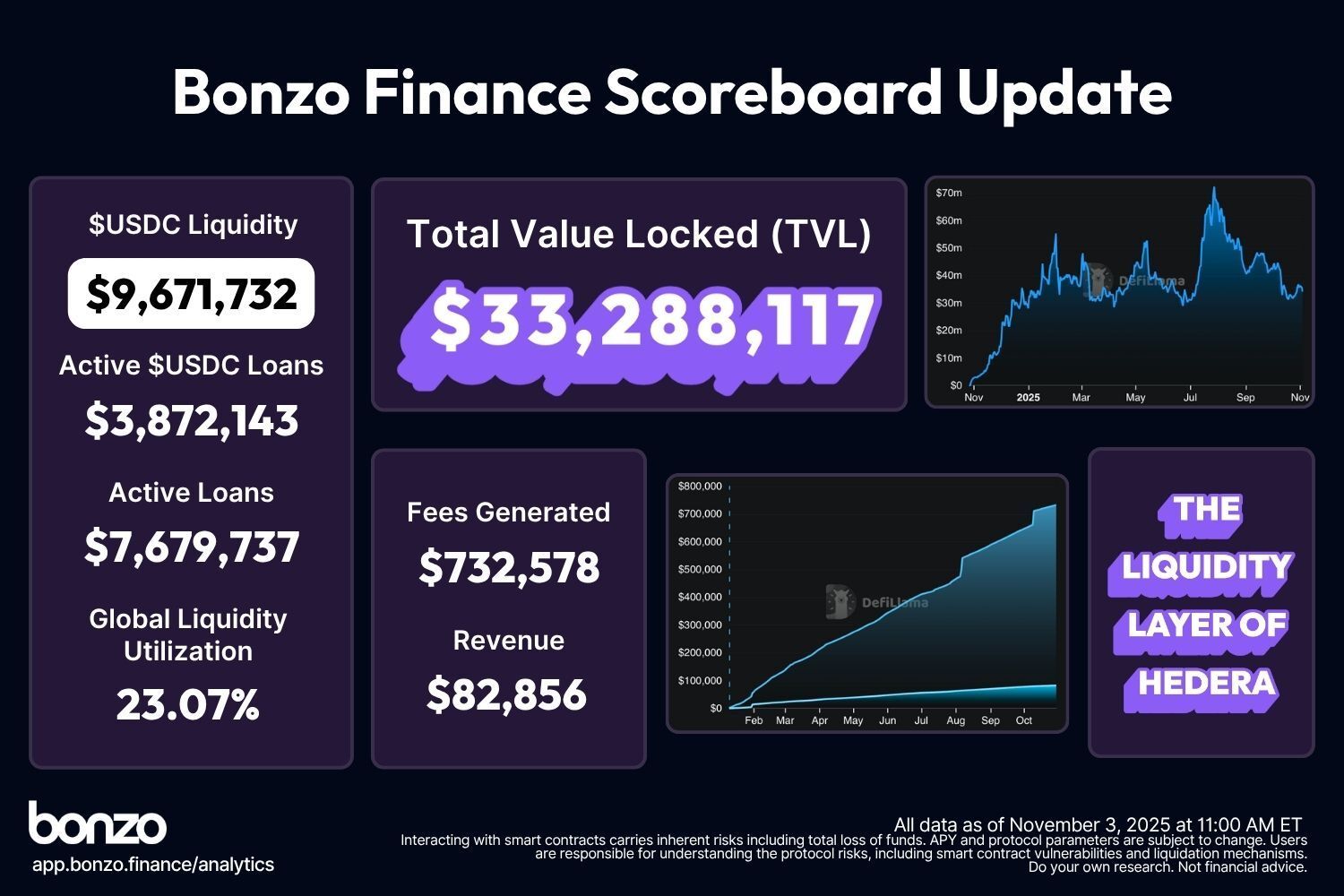

Bonzo Finance TVL & Scoreboard Update

Community Q&A Highlights

During the Space, community members asked about which ERC-20 assets Bonzo Finance plans to support next. The most likely candidates are $wBTC and $USDT0.

There are a few prerequisites to support any asset on Bonzo Finance:

Each new asset must have bridge support via LayerZero (Stargate) or Axelar (Squid), substantial secondary liquidity on SaucerSwap (paired with major tokens like $USDC or $HBAR), and a risk assessment from Re7 that includes a formal change memo or, post-DAO, a governance proposal. Reliable oracle pricing from Chainlink and/or Supra is also required.

Brady also noted that institutional participation in Bonzo Lend continues to rise. While retail users remain active, most lending activity across Web3 comes from funds and institutional players. As more of them onboard to the Hedera ecosystem, demand is expected to focus on major, high-volume assets like $wETH, $wBTC, $HBAR, $USDC, and $USDT0. This is beneficial for Bonzo Lend, as it drives significantly larger amounts of capital (TVL) and borrowing, resulting in more protocol revenue and overall liquidity across Hedera DeFi.

Bonzo Proposes A “Win-Win” Adjustment

Bonzo Finance Labs has opened a Request for Comment (RFC) on SaucerSwap’s governance forum addressing how new $HBAR native staking rewards, now targeting 2.5% APY, could be shared between Bonzo and SaucerSwap.

Currently, Bonzo users have deposited about $11.5M in HBAR, which is wrapped into wHBAR using SaucerSwap’s contract. Those pooled HBAR deposits contribute to SaucerSwap’s daily $SAUCE buybacks via staking rewards. The proposal suggests attributing Bonzo’s proportional share of those staking rewards back to the Bonzo ecosystem, either through $BONZO buybacks (to support $xBONZO emissions) or allocation to a Bonzo protocol-owned account for governance-directed use.

The discussion aims to create a win-win alignment between Bonzo Finance and SaucerSwap, ensuring rewards generated from Bonzo-sourced HBAR benefit both communities.

CoinGecko / CoinMarketCap Pricing

Hedera HTS prices on CoinGecko and CoinMarketCap remain inaccurate following a Hedera codebase update that disrupted how these sites pull on-chain data for several assets. Bonzo Finance’s price feeds are unaffected, as the protocol sources data from Supra and Chainlink, both of which reference SaucerSwap as the network’s de facto source of truth.

HederaCon 2026 Announced

📢 Register early: HederaCon 2026 lands in sunny Miami Beach on May 4, 2026.

🌴Between the @F1 Miami Grand Prix and @consensus2026, the Hedera community will gather for a day of innovation, connection, and real-world impact.

More to come. Don’t miss out!

Register interest

— Hedera (@hedera)

5:14 PM • Oct 30, 2025

Mark your calendars, HederaCon 2026 will take place at the iconic Faena Forum in sunny Miami Beach, Florida on May 4th.

After a successful inaugural HederaCon in Denver, the Hedera community will gather for a day of collaboration and connection.

Positioned between two of the most high-energy events of the year in Miami, the Formula 1 Miami Grand Prix and Consensus 2026, this will be a one-of-a-kind experience where builders, Council members, enterprises, and industry leaders come together to explore the future of trust and real-world innovation.

HederaCon 2026 will bring together the entire Hedera ecosystem, including Hedera Foundation, Hashgraph, Hedera Council, and The Hashgraph Association, alongside partners, policymakers, and end-users.

HBAR ETF Goes Live

📈 Canary $HBAR ETF inflows visualized

4 days after launch, the fund has grown from 5.5M → 360M HBAR

Over $70M AUM in less than a week.

— TaTa ◕_◕ (@hbarTaTa)

1:11 PM • Nov 3, 2025

Wall Street opened a new chapter for altcoins this week as Canary Capital launched the first U.S. exchange-traded product tied to Hedera (HBAR), alongside new ETFs for Litecoin and Solana. Institutional participation continues to rise as investors gain exposure to HBAR through regulated investment products.

The HBAR Bull and Zepzi break down their take on the ETF launch below.

EQTY Lab Launches Verifiable AI Governance on Hedera

🚨 @EQTYLab Launches Verifiable Governance and Sovereignty for Public Sector Agentic Systems on @hedera

The solution brings together advanced multi-agent orchestration, verifiable compute, and enterprise blockchain attestations to deliver transparent and accountable AI

— TaTa ◕_◕ (@hbarTaTa)

3:27 PM • Oct 29, 2025

EQTY Lab has introduced a verifiable governance and sovereignty framework for AI systems built on the Hedera network, in collaboration with Hedera Foundation. The solution leverages Nvidia architecture to enhance accountability, privacy, and oversight for agentic AI operations.

The framework aims to address key challenges in AI governance, such as transparency and privacy-preserving automation, by anchoring verification directly on-chain. The integration positions Hedera as a leader in combining AI infrastructure with enterprise-grade blockchain governance.

Citi Partners With Coinbase and Prepares 2026 Crypto Custody Launch

Citi is expanding its digital asset strategy through a new partnership with Coinbase and plans to launch crypto custody services in 2026.

The collaboration will allow institutional clients to move fiat and digital assets seamlessly, with future plans to enable stablecoin conversions for on-chain payments. Citi’s custody service, two years in development, will provide a regulated way to hold assets such as bitcoin and ether by combining internal tools with third-party partners.

Together, these initiatives highlight how traditional banks are building the infrastructure that connects institutional finance and DeFi.

🔗 Read more on Reuters: Citi to tie up with Coinbase to boost digital payments for institutional clients

The Hashgraph Group Launches AssetGuard for Enterprise Digital Asset Security

The Hashgraph Group (THG) has launched AssetGuard, a new enterprise wallet built on the Hedera network to deliver secure, compliant, and auditable digital asset management for organizations.

AssetGuard combines decentralized recovery (DeRec), agentic governance automation, and role-based access controls to simplify key management and reduce operational risk. The wallet integrates with existing enterprise systems through APIs and single sign-on, offering programmable liquidity management, multi-signature approvals, and ISO 27001-aligned safeguards.

Designed for corporate treasury operations and institutional digital asset adoption, AssetGuard represents a major step toward secure enterprise participation in the Web3 economy.

Bonzo Finance AMA

Tune in on Friday, November 7, for the monthly Bonzo Finance AMA. Anonymously submit a question for the team here.

Thank you for being part of Bonzo Finance and the Hedera DeFi 2.0 journey.

- The Bonzo Finance Team

The views shared in this newsletter are personal opinions and do not represent official Bonzo Finance advice. Any forward-looking statements about Bonzo Finance and its associated projects involve risks and uncertainties. Please do your own research and consult a professional before making any investment decisions. Bonzo Finance is not liable for any actions taken based on the information provided.